How do consumers feel about the industry’s biggest sporting event?

As the largest US sporting event, the Big Game often brings advertising’s hottest trends to the forefront of industry conversations. All the stops are pulled out from emerging formats to amped up messaging and tone and of course... celebrity cameos. With billions invested, marketers can learn a lot from which ads score big with consumers – and those that miss the mark.

Last year, DISQO’s Big Game Brand Lift report ranked ads by creative appeal and brand lift. This year, we explore pre-game attitudes to understand how demographic cohorts think about the event differently, how brands can maximize ad engagement outside of the game, and how Big Game ads influence overall brand experience.

Download the above and read on for the full view of the insights you need to refine your sports advertising strategies.

Resonating with next-gen sports fans

The world of sports advertising is evolving fast to keep pace with fan expectations. Younger consumers have made it clear that they seek more interactive experiences, deeper connections with athlete influencers, and more authentic brand messaging. Below, we examine how Big Game engagement differs across generations.

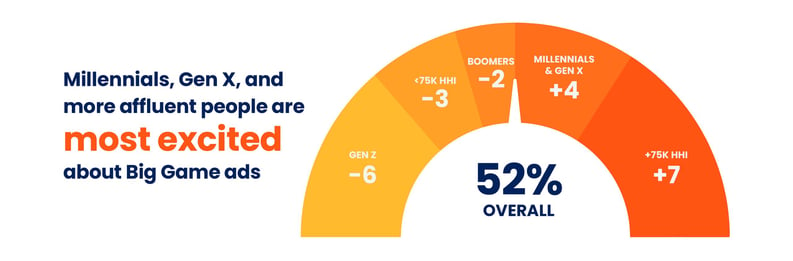

Excitement for Big Game ads

Millennials and Gen Xers are most excited about Big Game ads, likely because they grew up during the time when they became such a big cultural phenomena. Gen Z, the generation that has turned their backs on traditional sporting events, is the least excited out of any demographic cohort. They were also most likely to say they weren’t planning to watch the Big Game at all.

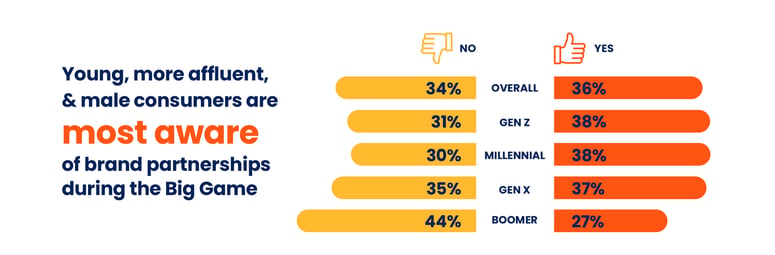

One way in which advertisers can reach younger consumers is through brand sponsorships. As outlined in the chart below, Gen Z and Millennials are far more tuned into brand sponsorships than Boomers are. Advertisers seeking to sway younger viewers during the Big Game (and other sporting events) may have more success leveraging sponsorship experiences versus traditional ads.

Awareness of Big Game brand sponsorships

To learn more about demographic differences across gender and income, download the full infographic by clicking below.

Maximizing engagement opportunities off the field

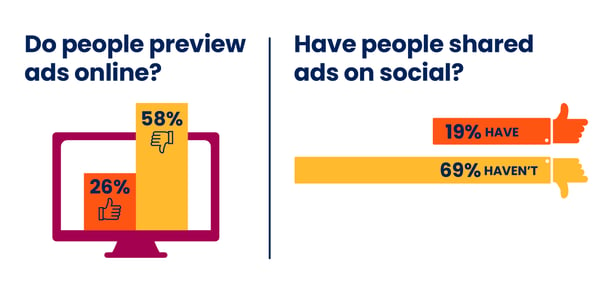

To maximize the impact of their Big Game tentpole moments, some advertisers release their ads online prior to the game. Social media has extended the buzz, offering brands opportunities to engage with consumers before, during, and after the game. For example, TikTok Pulse offers the capability to run ads alongside trending sports content.

Do consumers actually notice and engage with these efforts? Let’s take a look.

Only a quarter of consumers say they view Big Game ads online outside of the game, and less than one-fifth say they have shared one of the ads on social media, before or after the game. Findings suggest that advertisers and publishers still have work to do in maximizing ad engagement outside of the Big Game. Of course, as social media platforms introduce new experiences for pre-game and post-game activations, this may change.

For now, brands should facilitate easy sharing of information on social media platforms about their Big Game ads. Our insights show that humor (50%) and entertainment value (25%) are most likely to motivate consumers to share Big Game ads. Creating content that sparks conversation online ensures that your investments organically become part of the social discourse. You may also find that these efforts resonate more with younger generations that may not be as engaged on game day.

Do Big Game ads score with viewers?

Beyond social media chatter, Big Game advertisers want to know that their investments are moving the needle for their brand in measurable ways. When asked if they found Big Game ads more entertaining than those they see throughout the rest of the year, 59% of consumers said they were. Entertainment value can go a long way in whether or not your brand sticks around with consumers.

59% of consumers find Big Game ads more entertaining than ads that they see throughout the rest of the year.

Seventy-five percent (75%) of consumers said that Big Game ads have no impact on their perception of participating brands, and only seventeen percent (17%) said they felt more positively. Our 2023 Big Game Brand Lift report found that brands or products with little existing awareness prior to the game saw the most brand lift. Big Game presence moves the needle in brand perceptions for emerging categories far more than it does for a household name.

Looking further down the funnel at purchase activity, about one-fifth of consumers say they have made a purchase from a brand after seeing their Big Game ad, and another quarter are unsure. This is not all too surprising given that tentpole events like the Big Game are all about driving brand awareness. It’s likely that as more advertisers facilitate the path-to-purchase in a Big Game ad (i.e. QR codes) like we’ve seen in recent years, the more they will see increased purchase activity.

Get more sports advertising insights from DISQO!

Download our Big Game Ads & Brand Experience infographic for more data. Insights informing this article and the infographic are based on a survey of ~10,000 consumers, fielded from Jan. 27-29 2024, and representative of the U.S. population.

Thinking about investing in sports advertising? DISQO provides holistic, cross-media ad measurement, enabling powerful conclusions about performance across audiences and channels, and against competitors.

.jpg?width=352&name=DIS_InGameAdvertising_PreRelease_Web_Header_1000x666%20(1).jpg)