Next to the Super Bowl, March Madness is one of the biggest annual sporting events, where brands can reach a diverse, highly-engaged audience, but at a much lower cost. This year, the NCAA tournament viewership reached all time highs, and the sheer volume of consumers playing along in March Madness brackets is a testament to its engagement power. Accordingly, the widespread appeal has opened new avenues for brands to reach consumers.

To help marketers better understand the March Madness advertising play, we asked DISQO’s audience about their experiences. We uncovered which audiences are most engaged, how consumers say they are watching the games, and how the event’s signature bracket impacts consumer attitudes and behaviors. Leveraging the DISQO CX platform, we surveyed 30,849 consumers from March 11 to 13, 2023. Read on for key findings.

Who participates in March Madness mania?

In many circles, sports is perceptively relegated to a boys club, so we first examined how that theory stacks up. We found that it holds fairly true, with males making up 67% of self-reported tournament watchers in our audience. However, with an audience of this scale, it’s worth noting that females (33%) should not be overlooked when developing tournament-related content. The gender makeup of bracket creators nets about the same (70% male vs. 30% female).

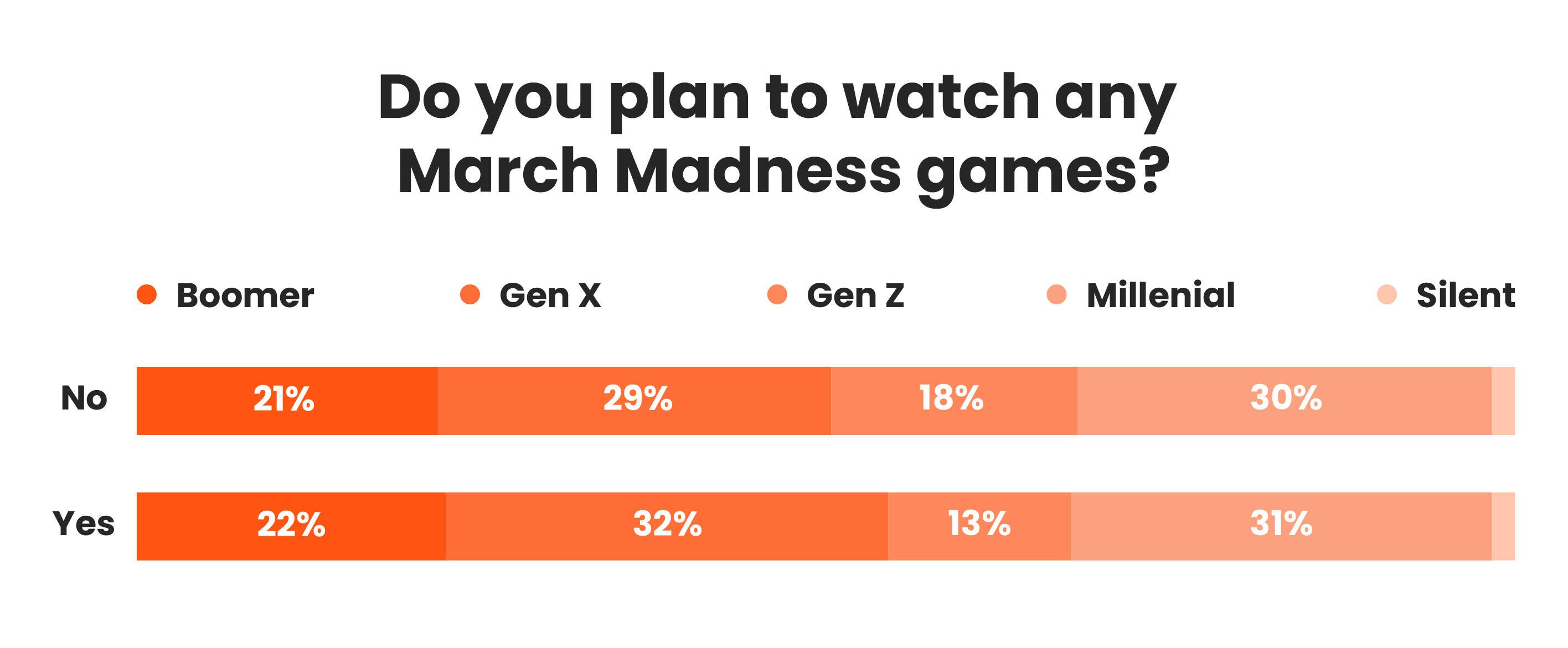

When it comes to generational differences, Gen X is the most leaned in, comprising 32% of the people who said they watched the tournament, with Millennials close behind at 31%, Boomers at 22%, and Gen Z at 13%.

Interestingly, Gen Z’s engagement rises in bracket creation (21%), neck-in-neck with Gen X (20%) and Millennials (24%), and far above Boomers (13%).

Do brackets really change the game?

March Madness’ iconic brackets extend far beyond tournament watchers, with many people participating, even with limited knowledge of basketball or team records. In fact, ESPN’s 2023 “Go with your gut” campaign leaned hard into the concept of creating brackets based on “vibes” vs. basketball knowledge. With that in mind, we looked at the power of the bracket system to draw in consumers who were not college basketball fans.

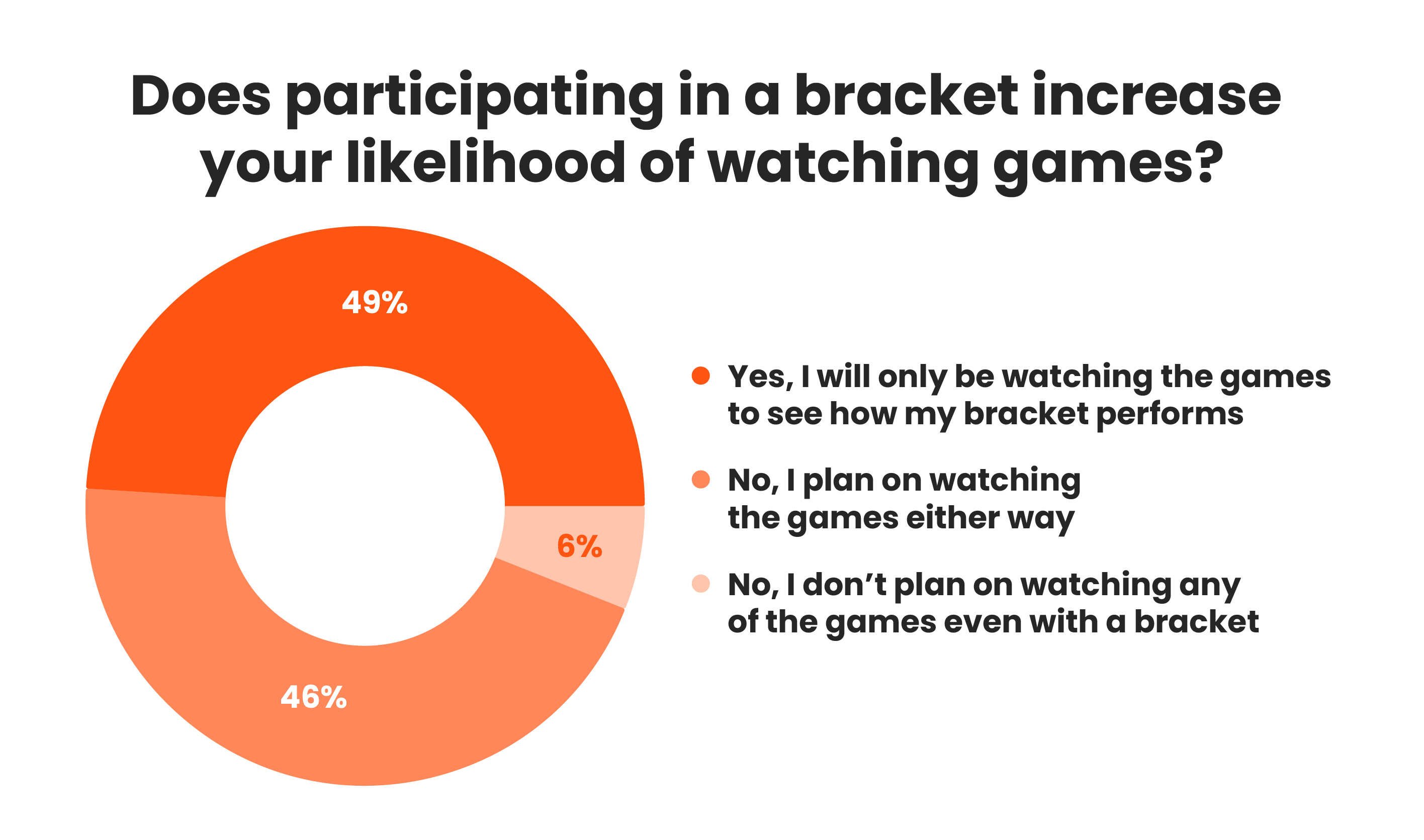

First, when we fielded our study, 20% of respondents overall had already created, or planned to create, a bracket. Of those who planned to watch the games, the number rose to nearly half (47%).

Forty-nine percent (49%) reported that they would only be watching to see how their bracket performed. Another 45% said they planned to watch the games regardless of their bracket, while 6% said that they don’t plan to watch any of the games, even with a bracket.

The power of playing a bracket is undeniable, and this gamification for consumers has transformed the advertising opportunity. It brings in a more diverse audience and engages consumers even more than the tournament itself.

How do consumers typically watch March Madness?

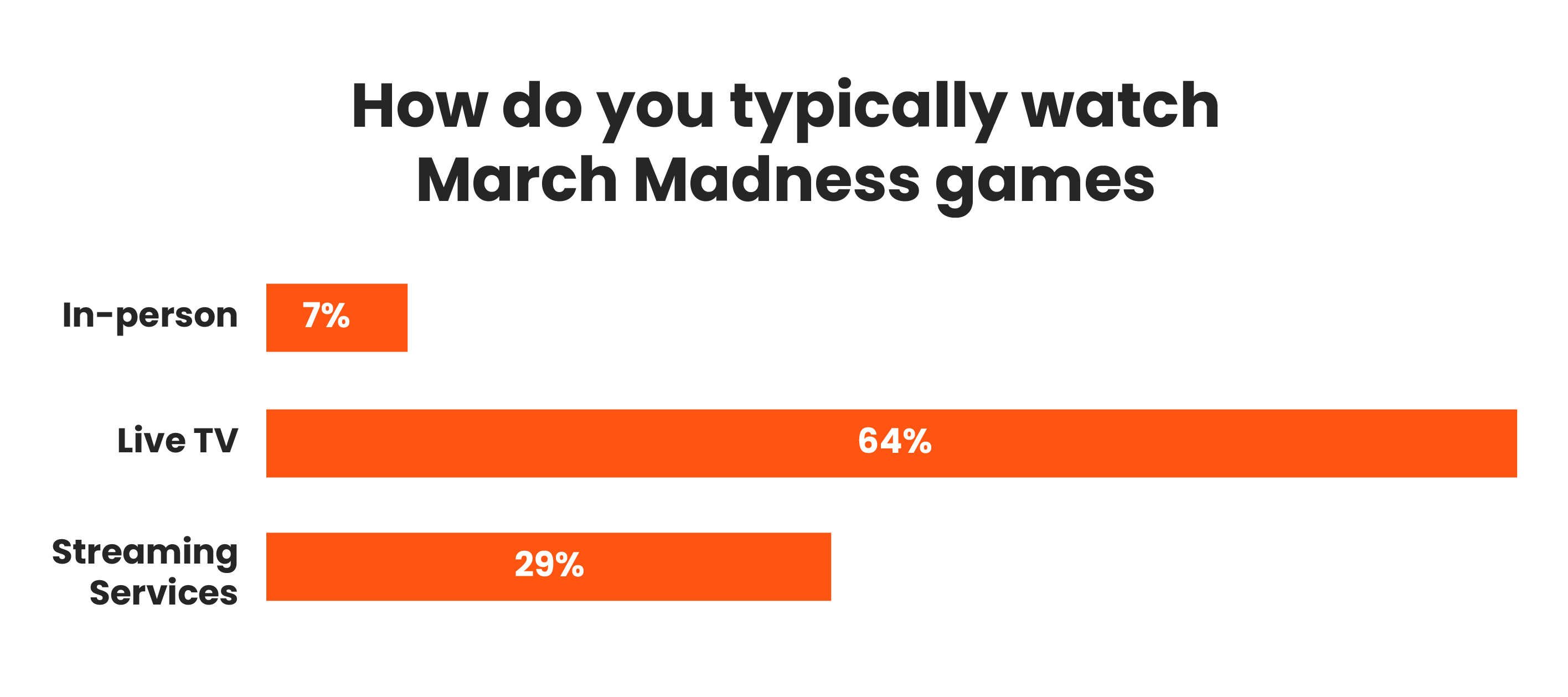

We also asked how people planned to consume the madness. Of those who planned to watch, 64% reported that they typically watch via live TV, 29% watch via streaming services and 7% said they typically watched at least one game in person.

Millennials and Gen X were among the most likely to watch via Live TV, 33% and 34% respectively, with Boomers coming in at 19% and Gen Z at 13%. Millennials were also the most likely to be watching via streaming services, making up 47% of streamers, while Boomers are the least likely (7%). Gen Z consumers were among the most likely to watch in person, likely due to their proximity to college campuses where many of the games take place, and their active participation in school activities.

Millennials and Gen X were among the most likely to watch via Live TV, 33% and 34% respectively, with Boomers coming in at 19% and Gen Z at 13%. Millennials were also the most likely to be watching via streaming services, making up 47% of streamers, while Boomers are the least likely (7%). Gen Z consumers were among the most likely to watch in person, likely due to their proximity to college campuses where many of the games take place, and their active participation in school activities.

Females were more likely to watch via streaming services, while males were more likely to watch via live TV. When it comes to income, those of higher income (>$75,000) were more likely to watch via live TV or streaming services, while those of lower income (and who also were more likely to be students) were more likely to go to a game in-person.

Key takeaways for brands considering March Madness content

There’s no doubt that March Madness offers a unique opportunity to engage consumers through branded placements, experiential activations, social media conversations and much more. But as sports advertising continues to grow, brands need unique and compelling strategies that engage the breadth of the audience.

- Consider an audience beyond basketball fans. Brands thinking of March Madness as simply another game will fall short with the large percentage of consumers that are engaged just for the fun of it. To move outside of the court, test specialized content for different people in the audience, while considering their interests and motivations.

- Tap into the bracket experience. Consumers love the now iconic brackets, and brands should capitalize on this to align with their other interests. Whether it’s creating a product-related bracket on social media or tapping into the bracket theme in traditional advertising, give customers the experience they’re looking for from March Madness.

- Meet your audience where they are. Consumers are watching the games, checking live updates and scores, and connecting with others on social media. Brands have a plethora of ways to reach consumers during March Madness, and those that experiment, measure and iterate will ultimately win the game.

Considering content related to March Madness? DISQO has solutions for you.

The DISQO CX platform includes Ad Testing for optimizing March Madness creative and messaging, robust Audience solutions for deep insights into every customer, and the only at-scale solution for measuring brand and outcomes lift via a single source.

Looking to dive deeper into sports advertising?

Check out DISQO’s 2023 Big Game Brand Lift report for more takeaways on how brands can score big with fans. Download it here.