There’s no denying it; generative AI is officially everywhere. Our latest report exploring the evolution of generative AI consumer perceptions found that usage is up 40% in just two short months.

Novel applications continue to emerge across industries. The financial services sector, for example, is at a critical juncture with the implementation of AI and virtual assistants, and the need to balance efficiency with customer experience (CX). Understanding consumer perceptions of the technology and determining the necessary measures to inform and educate customers effectively will be critical.

To help banks and financial providers effectively navigate this new era with their customers, we used DISQO’s CX platform to uncover consumer attitudes toward AI applications in the financial sector.

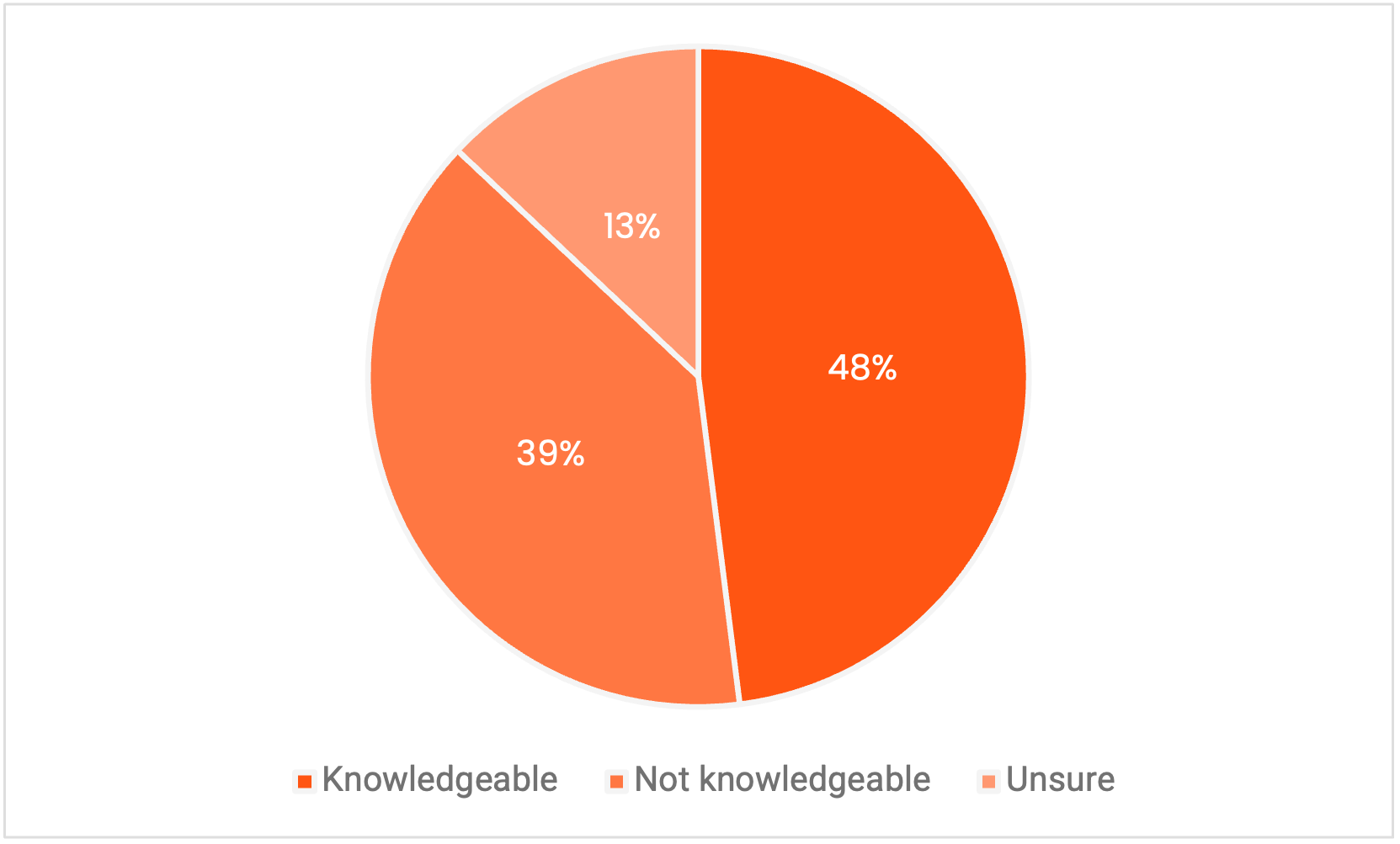

Consumers are unaware of AI applications in finance

Although AI has been widely implemented in financial services, encompassing everything from customer engagement to fraud detection, awareness of these applications is low. Fifty-nine percent (59%) of respondents reported that they had either “no knowledge at all” or “limited knowledge.”

Knowledge of generative AI in financial services

How knowledgeable or not are you about the use of AI in the financial industry?

That being said, many consumers have already experienced an AI application when interacting with a bank or provider. Forty-eight (48%) of the respondents reported that they had interactions with AI-powered tools, like chatbots or virtual assistants, in banking, and less than half have had good experiences (47%) so investing resources into testing how different variations impact reception is critical.

Self-reported interactions with AI applications in banking

Have you ever had AI-enabled interactions with your bank?

Our findings suggest that older generations may be surprised to learn that banks were using AI technology. As such, ensuring that disclosure is presented lightly or with human-augmented language is key to keeping trust with older consumers.

Consumers recognize the benefits of AI, but still harbor many concerns

When asked about the most appealing aspect of AI-enabled communication in banking, most respondents mentioned saving time, fast service, increased access, and reduction of repetitive tasks.

Most appealing aspects of AI-enabled interaction tools

What’s the most appealing aspect of AI-enabled interaction tools to communicate with your bank?

Consumers also voiced their reservations about AI. Many pointed out that the capabilities of such tools are still limited; AI-powered chatbots and virtual assistants are only able to handle simple requests, such as checking balances and answering pre-programmed questions. They believe that human agents are still needed to understand nuanced requests and perform more complex tasks.

“If I had a unique problem ("off script"), I might still need a human to solve it, which means I would have to go through the process twice.”

-Female, 58 years old, Oregon

Some consumers are worried that AI will eliminate jobs and pose threats to society. Others feel that AI-powered communication tools are indicative of diminishing customer service.

“It’s not only a lack of human care; it’s the intimation that they have no time for me or can’t be bothered, that I’m a drain on them.”

-Male, 64 years old, Pennsylvania

In general, consumers maintain a skeptical stance regarding AI's capacity to handle intricate requests and still seek human interaction and personalized service.

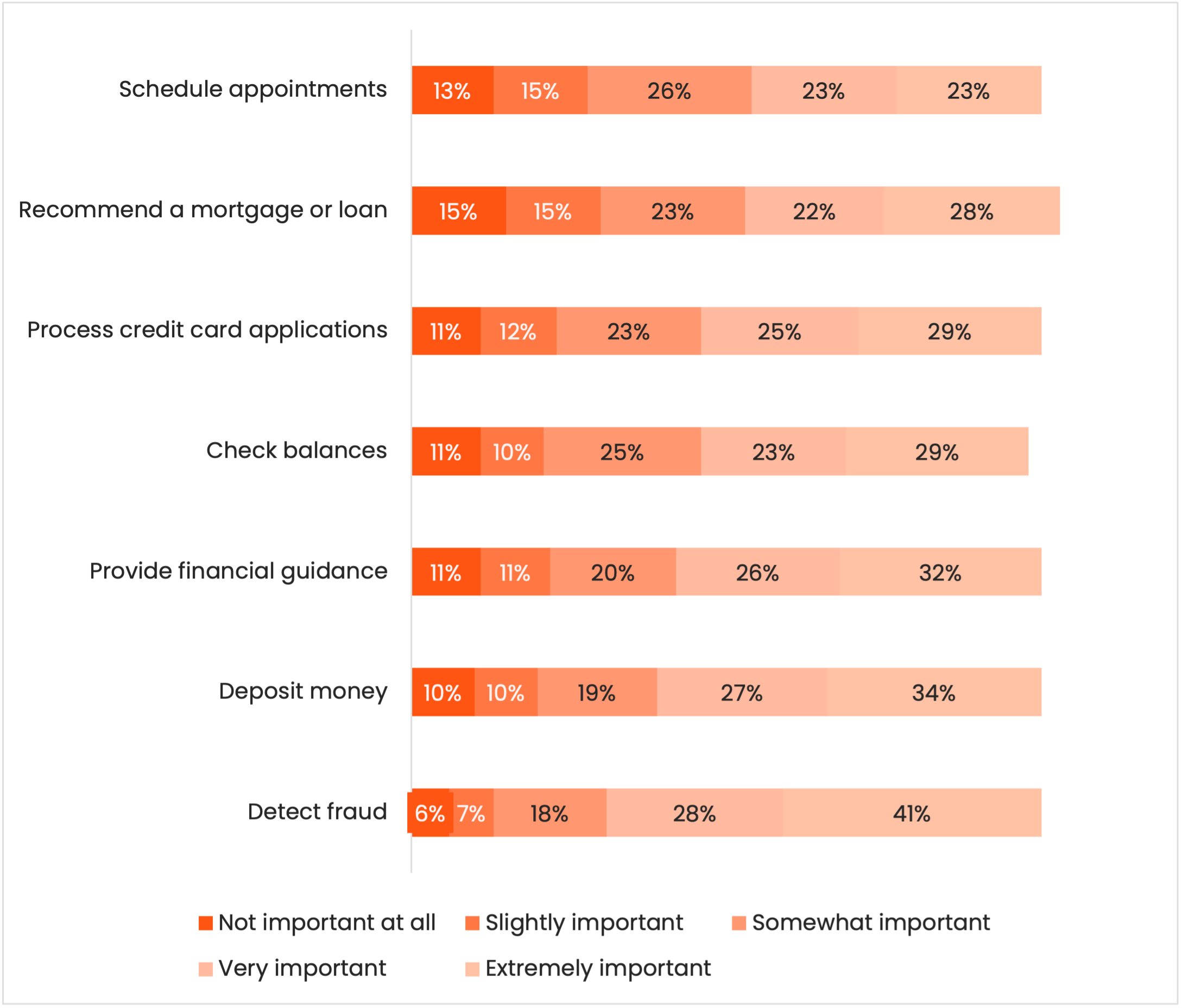

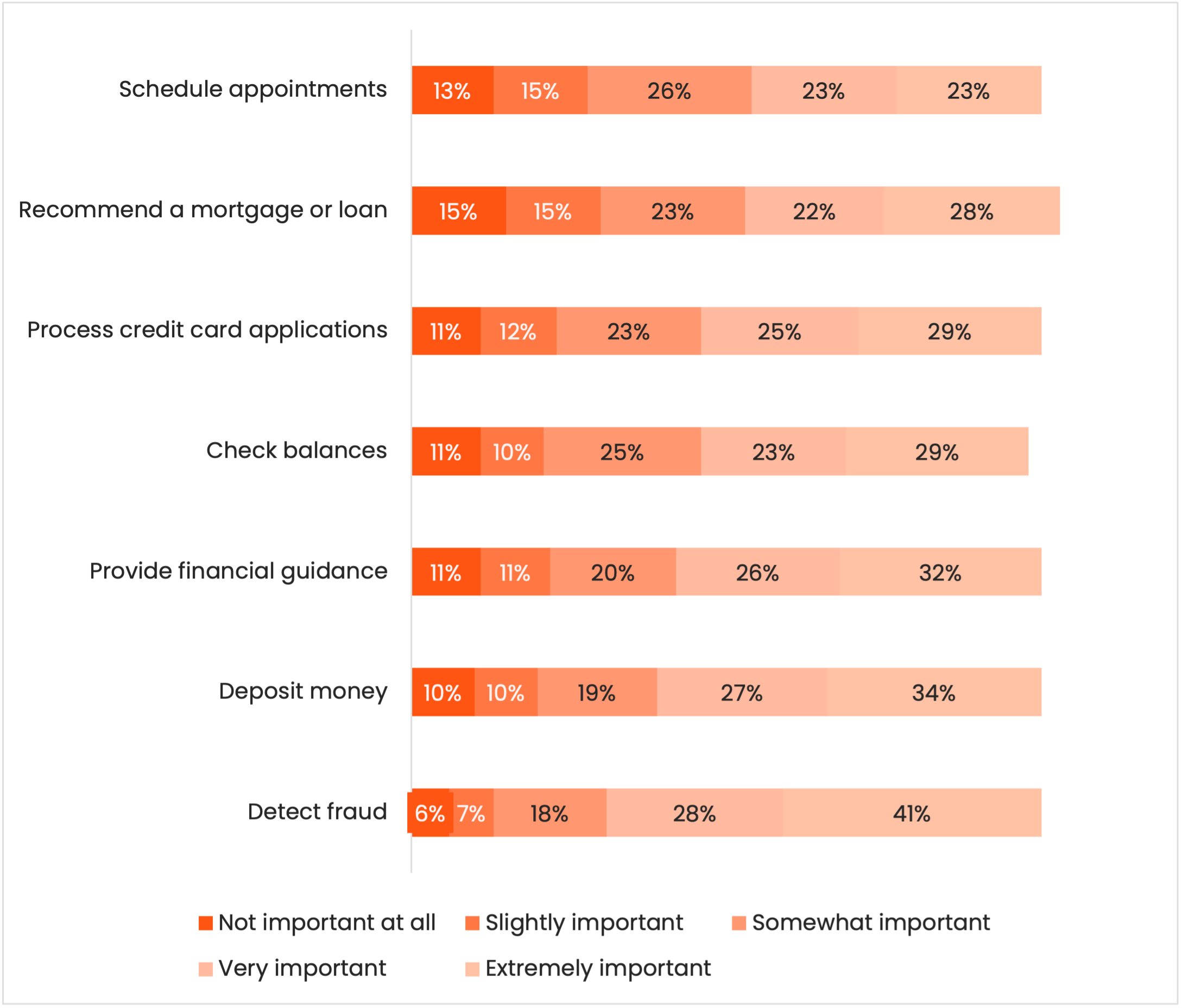

Receptivity to AI varies by task

Over half of the respondents stated that AI would be extremely or very reliable when used to check account balances (66%), schedule appointments (58%), and detect fraudulent transactions (52%). Slightly less than half believed that AI would be extremely or very reliable for processing credit card applications (47%) and depositing money (45%), and less than a third believed AI to be reliable in providing financial guidance (29%) and making mortgage or loan recommendations (28%).

Disclosure is a must

Consumers also demand disclosure from banks or providers using AI. The majority of respondents said it is important for them to be informed when AI is used by their banks to detect fraudulent transactions (69%) and deposit money for them (61%). Over half believed it to be important when AI is used to provide financial guidance (58%), check account balances (56%), process credit card applications (54%), and recommend a mortgage or loan (50%). Even for scheduling appointments, 46% still expect disclosure.

Overall, consumers are more receptive to AI in straightforward tasks that do not require human judgment and have a relatively indirect impact on their finances.

Importance of disclosure regarding AI from banks by context

How important or not is it for you to be informed when AI is used by your banks to…?

It’s worth noting that, in our larger report, 84% of consumers said it was very (60%) or somewhat (24%) important for firms to disclose AI use. Compared to these findings, it appears that disclosure is slightly less important for banking than it might be for other AI-generated content (songs, entertainment, books, etc.).

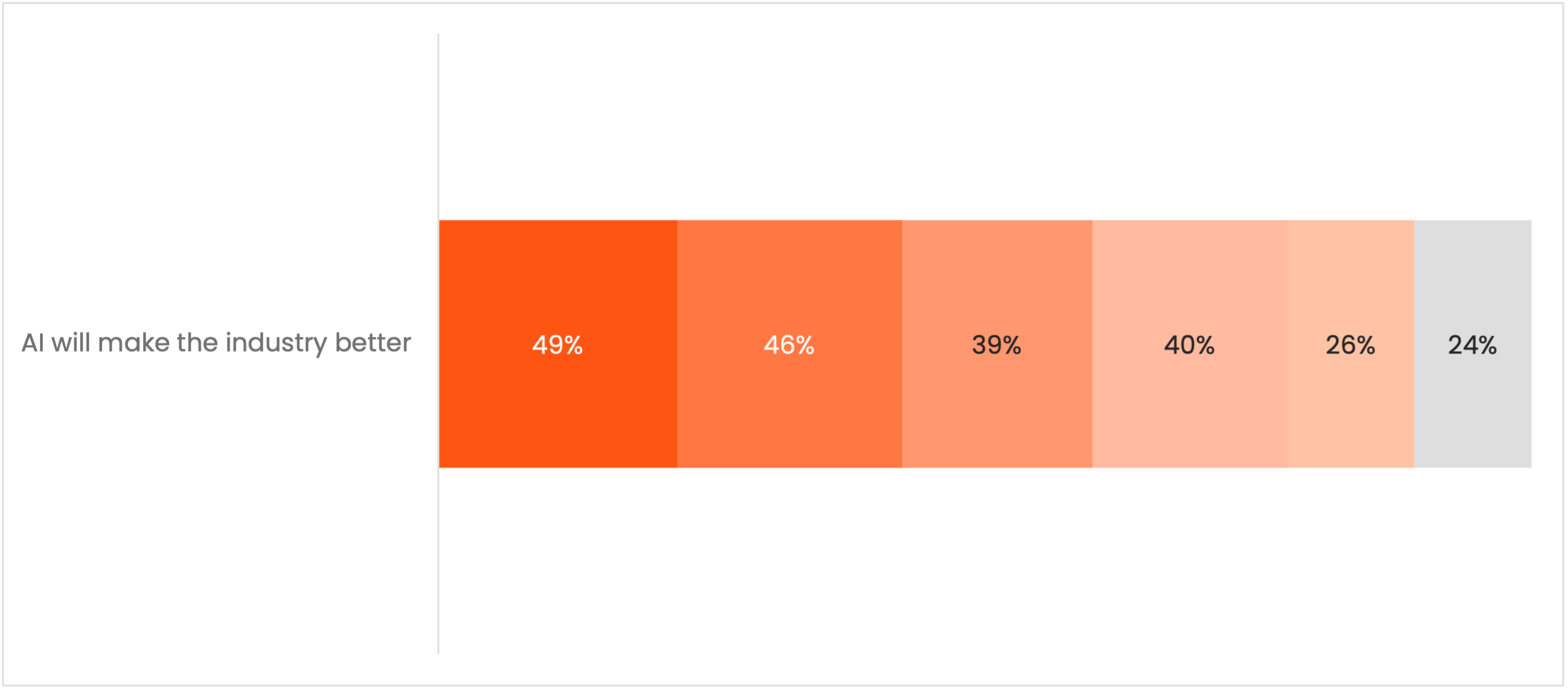

Consumers have yet to embrace AI’s role in the financial industry

Despite the hype, consumers remain skeptical of AI’s role in the financial sector. Almost half (49%) of the respondents said that they were only slightly likely (25%) or not at all likely (24%) to be willing to share data with banks for more personalized services. Furthermore, 76% of respondents said that they were only slightly likely or not at all likely to pay for an AI financial advisor’s service.

Respondents were also divided in their opinions about the potential impact of AI on the financial sector. 37% believed that AI would make the industry worse, while about the same percentage shared the opposite view. This division is most significant between younger (18-24) and older (65+) generations, with younger consumers being 2x more likely to think that AI will have a positive impact. Banks and other financial institutions will need to sway older customers if they want to broadly incorporate AI into their services.

Impact of AI on the financial industry in the next five years

How do you think AI will affect the financial industry in the next five years?

Key takeaways for brands

Overall, the findings reveal a prevalent lack of public awareness regarding the implementation of AI in financial contexts. While consumers are generally at ease with AI handling basic tasks, like balancing checks and scheduling appointments, they have reservations about relying on AI for financial guidance. Additionally, consumers express a strong desire for enhanced transparency from banks regarding the utilization of AI in delivering financial services.

While consumers recognize certain advantages of AI-powered communication, such as speedy service and constant availability, they maintain a degree of skepticism regarding AI's proficiency in comprehending "off-script" inquiries and managing intricate requests. AI is not efficient for the customer if they have to navigate an AI chatbot first only to restart the process with an agent who is a real person later. Moreover, many express concerns about AI replacing human jobs and depriving them of valuable human interaction and personalized service.

From a generational perspective, Gen Z and Millennials lean toward a more positive outlook, but older generations hold notably less optimistic views. To integrate AI into their services, financial companies and institutions must exert additional efforts to convince their older customers of its value and benefits.

Methodology

Leveraging the DISQO CX Platform, we surveyed 1,744 respondents (ages 18 to 75), who currently own a bank account on May 10, 2023.

Looking to dive deeper in the world of AI? Download our latest report on the evolution of consumer perspectives of AI. And learn how you can use DISQO’s CX platform to test and learn about your AI-powered experiences.